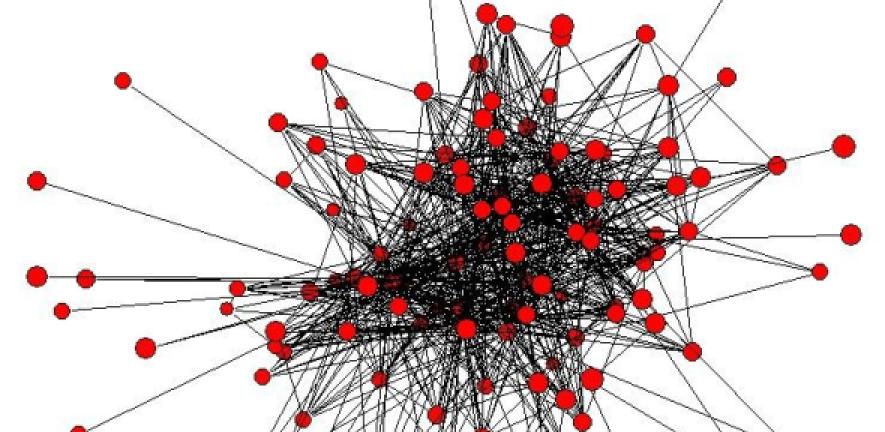

The recent financial crisis has underlined the necessity of rethinking financial regulation from a systemic risk perspective and has oriented regulatory thinking in the direction of macro-prudential regulation, which seeks to safeguard the financial system as a whole. In this approach, which emphasises the interconnectedness of financial institutions, their interactions and the resulting externalities, we see how network models have provided useful tools for exploring the link between the structure and stability of the financial system.

Objectives

This Open for Business event was part of an Isaac Newton Institute research programme on Systemic Risk and was co-organised with the Bank of England and the Turing Gateway to Mathematics. This one day workshop highlighted recent research contributions and regulatory initiatives, with an emphasis on the role played by network models in understanding systemic risk.

Programme

Please follow this link for the Programme

Venue

Bank of England, Threadneedle Street, London, EC2R 8AH.